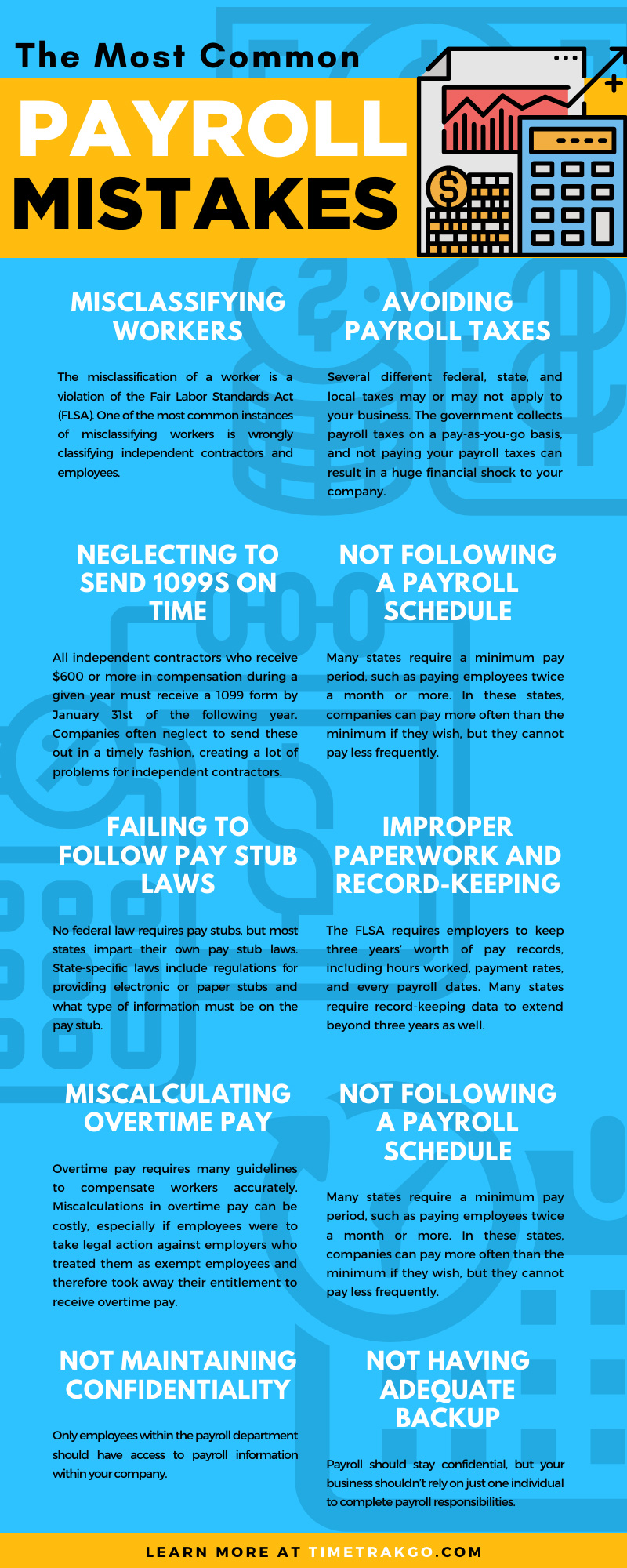

Payroll is a complex process that must follow various federal, state, and local rules and regulations. It’s also one of the most essential business functions that business owners don’t often think about unless something has run amuck. Keeping payroll in check keeps employees happy and protects your business from legal repercussions. Here are some of the most common payroll mistakes that get companies in trouble.

Misclassifying Workers

The misclassification of a worker is a violation of the Fair Labor Standards Act (FLSA). One of the most common instances of misclassifying workers is wrongly classifying independent contractors and employees. Employees and contractors are very different, especially concerning benefits and taxes. Misclassifying an employee as a contractor also tends to have tax consequences.

Avoiding Payroll Taxes

Avoiding payroll taxes is one of the most detrimental mistakes you can make as a business owner. Several different federal, state, and local taxes may or may not apply to your business. The government collects payroll taxes on a pay-as-you-go basis, and not paying your payroll taxes can result in a huge financial shock to your company. Your business will eventually receive a hefty fine due to missed or late payments. Keep track of all deadlines to state, local, and federal agencies to ensure you don’t end up with a fine.

Misclassifying Exempt vs. Nonexempt Employees

The FSLA regulates how to treat employees based on various work-related matters, including payroll. Employees are either exempt or nonexempt based on FLSA requirements. Getting this classification right is crucial to keeping records in order, paying employees accurately, and avoiding penalties and backpay for overtime workers put in the wrong class.

Nonexempt employees must be paid a minimum wage and receive overtime pay for any hours worked after the base of 40 hours a week. In some states, such as California, overtime pay is necessary if a nonexempt employee works more than eight hours in a day rather than 40 hours a week.

To be exempt from FLSA requirements, an employee must meet several requirements, including making a minimum salary and working in a role that’s necessary for the business but whose success is not tied to hours.

Neglecting to Send 1099s On Time

All independent contractors who receive $600 or more in compensation during a given year must receive a 1099 form by January 31st of the following year. Companies often neglect to send these out in a timely fashion, creating a lot of problems for independent contractors. Likewise, employees will need to receive W2s on time as well.

Not Following a Payroll Schedule

How often you pay your employees has an enormous effect on your business operations, cash flow, and employees. Some of the most common payroll frequencies in the US are weekly, biweekly (every two weeks), semi-monthly (twice a month), and monthly. Many states require a minimum pay period, such as paying employees twice a month or more. In these states, companies can pay more often than the minimum if they wish, but they cannot pay less frequently.

The type of payment frequencies your business pays could be costing you money. For example, a monthly payment schedule has the lowest processing costs and time constraints. However, this option might be the most inconvenient for employees.

Failing To Follow Pay Stub Laws

No federal law requires pay stubs, but most states impart their own pay stub laws. State-specific laws include regulations for providing electronic or paper stubs and what type of information must be on the pay stub. As with most payroll rules, there are fines and penalties for ignoring pay stub laws.

Improper Paperwork and Record-Keeping

The FLSA requires you to keep accurate records about payments to nonexempt employees, including but not limited to:

- Pay periods

- Dates and hours worked

- Hourly rates

Of course, violating these rules comes with penalties as well. Similarly, keeping sloppy or incomplete records is an unacceptable mistake to make. The FLSA requires employers to keep three years’ worth of pay records, including hours worked, payment rates, and every payroll dates. Many states require record-keeping data to extend beyond three years as well. Missing or incomplete records could create significant problems down the road.

Miscalculating Overtime Pay

Overtime pay requires many guidelines to compensate workers accurately. Miscalculations in overtime pay can be costly, especially if employees were to take legal action against employers who treated them as exempt employees and therefore took away their entitlement to receive overtime pay. Systems such as web-based time clock software can reduce overtime calculation errors.

Not Maintaining Confidentiality

Only employees within the payroll department should have access to payroll information within your company. Payroll information should also be handled in a secure environment.

Not Having Adequate Backup

Payroll should stay confidential, but your business shouldn’t rely on just one individual to complete payroll responsibilities. Should the individual be sick or on vacation, the IRS, state, and employees still need their payments on time. More than one person within your business should be capable of understanding and handling the payroll functions. Additionally, if the computer system is down, you need to have a manual backup system for managing all payroll functions.

Failing To Report All Taxable Forms of Compensation

Most fringe benefits, such as stock options, work-related travel perks, and employee discounts, are subject to federal income and employment tax withholding. You must report these forms of compensation to the IRS, or your business could face significant penalties.

Misprocessing Garnishments

There are different rules for different kinds of employee garnishments, including fines, taxes, and child support. Failure to comply with processing regulations could result in penalties, and employees may struggle to receive payments that were processed wrongly.

Managing payroll can seem like a stressful process. Plenty of things can go wrong if your payroll team isn’t careful. Many errors and mistakes can not only lead to disgruntled employees but also result in large fines and daunting repercussions. Familiarize yourself with this list of the most common payroll mistakes to ensure your business doesn’t fall victim to any payroll-related penalties or punishment.